CIO Guide: How behavioural science can improve multi-manager performance

A multi-manager leverages diverse skills to achieve positive outcomes by investing across various asset classes and allocating capital to multiple external managers. As well as making asset allocation decisions, they must also select external managers who can be tasked with outperforming a specific market mandate. This requires deciding to which managers they will be distributing capital and then consistently monitoring their performance. In doing so, a multi-manager consolidates both their expertise and the ability to assess and oversee the skills of multiple specialised managers.

Main takeaways

Navigating complex challenges: multi-managers face pressure to balance asset allocation decisions with selecting external managers while coping with volatile markets and high-performance demands

Tailored feedback: multi-managers gain personalised insights into their own investment biases and strengths, helping refine decision-making and enhance outcomes based on their unique investment process

Deep external manager insights: SkillMetrics® analyses external managers’ decisions, uncovers behavioural biases, and identifies underperformance risks to improve diversification

Maximising impact: SkillMetrics® provides a data-driven foundation to monitor performance, foster collaboration, and drive resilient, long-term portfolio success.

SkillMetrics® for fund of funds

What is it?

SkillMetrics® revolutionises investment expertise by providing advanced behavioural insights tailored to professional portfolio managers. It is a cloud platform that identifies the strengths, areas for improvement, and behavioural biases that can affect overall performance. SkillMetrics® covers different asset classes, including equities, fixed income and multi-asset portfolios. For multi-managers, SkillMetrics® can either analyse their direct investment decisions or support in evaluating and monitoring external managers. CIOs and CEOs overseeing multi-manager portfolios leveraging SkillMetrics® can coach teams to enhance their investment processes and fully harness the benefits of behavioural diversification. It also empowers fund selectors with the tools required for skill identification and close monitoring.

Find out more about SkillMetrics®.

Case Study: How behavioural insights can improve performance

Background

A large investment team consisting of fund selectors, asset allocators, and specialised investors manages a suite of multi-manager funds. This product suite is designed for clients with different risk appetites: conservative, moderate, and aggressive allocations. Each fund aims to capitalise on the strong convictions developed by various contributors within a tightly controlled risk framework. Although the portfolios have maintained consistent performance, they have fallen behind top-ranking funds. Fastnet AMS was engaged to offer insights into the team’s current strengths and weaknesses.

Our objectives:

Optimise the contributions and interactions of team members

Allocate resources to areas that will enhance the quality of performance

Provide monitoring and coaching tools to improve the team’s skill set over time.

Step 1: Understanding the investment process

Engaging with the investment team provided a clear understanding of the strategies they employ to implement their investment ideas. This close collaboration enabled the creation of a robust set of rules for aggregating securities, as well as capturing the team’s decisions, their timing, and the resulting performance outcomes.

The key investment decisions were:

Four types of investment decisions

Asset allocation decisions: these are made by an investment committee and focus on medium to long-term positioning

Short-term opportunistic decisions: the portfolio manager will make calls geared towards taking advantage of short-term opportunities

Fund selection decisions: this involves identifying skilled managers that can outperform their respective asset classes

Satellite strategies: these involve specialist positions within the overall investment framework.

Fastnet AMS used its powerful portfolio construction engine to analyse the investment process, isolate each decision, and measure its contribution to the overall portfolio. The result was a rich database of relevant decisions, the environments in which they were made, and the outcomes achieved.

Step 2: Assess the fund research quality and highlight selectors’ own biases

Fund selectors maintain a research portfolio that includes their recommendations on a list of external managers. These will be: buy, on-watch and sell. A full analysis of the decision-making process behind these individual recommendations was made through the behavioural lenses of SkillMetrics®. This enabled us to measure the fund selector’s skills across multiple dimensions.

These included:

Identifying and selecting strategies that outperformed

Creating performance asymmetry by selecting strategies that excel in favourable conditions and mitigate losses in adverse ones

Making timely decisions on when to buy and sell.

The findings were thoroughly analysed with the fund research team, providing them with quantitative feedback on their decision-making process. This approach connected each step of the research process to measurable metrics. It enhanced their existing procedures, leading to a well-defined fund research framework supported by quantitative and objective metrics.

Findings

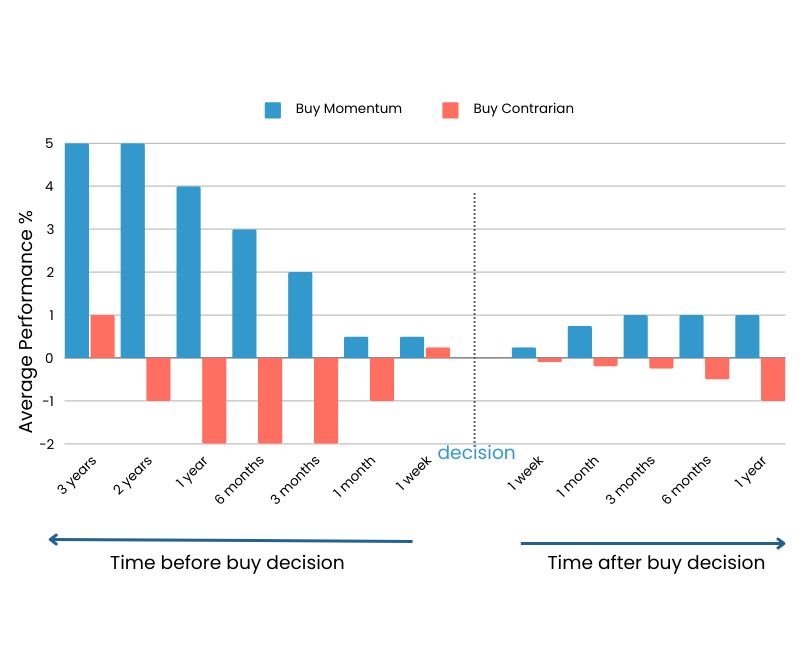

Performance before and after buying active fund

Our work also provided some interesting findings, including:

The management team had long believed fund selectors were buying past performers, but the analysis revealed there was no unique specific bias

It showed they focused on identifying managers with good investment discipline, including those who had performed – and underperformed – prior to the recommendations being made

However, the success rate enjoyed was found to be higher when it came to the past performers than the underperformers

Our recommendation was to widen the scope of research into underperforming names to help build a stronger conviction in them

The analysis also highlighted a propensity to hold managers for too long, with strategies kept unchanged tending to underperform

The research team now regularly revisits all the funds, focusing on those who have underperformed over a selected period; this avoids potential complacency bias.

Step 3: Unlocking the power of behavioural diversification

To fully understand the approach of external managers, the selection team obtained their historical portfolio holdings. Getting access to this rich set of data allowed them to delve deeper into each individual’s investment process and draw conclusions on their skill sets. It also enabled them to identify whether behavioural biases were behind their decisions, as well as potential areas for improvement. Here is how our advanced insights were used by fund selectors at different parts of the overall investment process.

Discovery stage: Helping to prepare questions for managers with areas of focus that align with their investment priorities. This enables them to get a head start on the investment process and focus on investigative questioning to uncover fresh information.

Confirmation stage: The information can be used to compare against manager comments during the meetings to highlight any apparent inconsistencies. Discussions are much more effective when multiple sources of information are used to validate positions and uncover potential hidden risks.

Engagement stage: As SkillMetrics® focuses as much on the outcome as the skills used to reach that result, it enabled a collaborative dialogue between the selector and manager. The higher level of transparency also strengthened the long-term partnership that is needed for the selector to achieve the desired strategy outcome.

Monitoring stage: It enables the monitoring of selected metrics that are relevant to each manager. This enables them to spot strategy drift at an early stage and prompt discussions with managers. This also gives selectors more confidence in their managers’ ability to build the strong conviction needed for the final portfolios.

Findings

When aggregating the behavioural traits of all external managers, fund selectors were able to effectively leverage the desired diversification in different investment styles. The behavioural insights reveal the market scenarios in which an investment manager may struggle to perform. This information is crucial in determining the complementary strategies needed to either bridge gaps in each multi-manager portfolio or tackle specific adverse market conditions. Fund selectors were also able to identify their own biases when choosing funds. Rules were set to mitigate some of the biases that were negatively affecting the diversification benefits. For example, the team identified a significant concentration in managers with a strong momentum bias that could lead to a concentration of losses when this approach isn’t in favour.

Conclusion

There are plenty of challenges for multi-managers when it comes to choosing the best combination of asset classes and external managers needed to generate the desired investment returns. However, behavioural science can not only help identify the factors that can lead to outperformance but also highlight potential problems that may derail longer-term returns. These include spotting inherent biases when it comes to the styles adopted by individual fund selectors, as well as the impact of holding managers for too long. Armed with these valuable insights, chief investment officers and multi-managers gain unparalleled opportunities to enhance returns, reduce risks, and, most importantly, save precious time by leveraging high-quality data effectively.

About:

SkillMetrics® revolutionises investment expertise by providing advanced behavioural insights tailored for portfolio managers. Our cloud platform identifies strengths, weaknesses, and behavioural biases, leading to improved performance. CIOs/CEOs can coach teams to enhance results by focusing on the investment process. Fund Selectors benefit from skill monitoring and behavioural diversification.

Read our next insight: How AI is transforming investment strategies